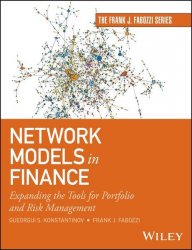

Название: Network Models in Finance: Expanding the Tools for Portfolio and Risk Management

Название: Network Models in Finance: Expanding the Tools for Portfolio and Risk ManagementАвтор: Gueorgui S. Konstantinov, Frank J. Fabozzi

Издательство: Wiley

Год: 2025

Страниц: 368

Язык: английский

Формат: epub (true)

Размер: 26.5 MB

Expansive overview of theory and practical implementation of networks in investment management.

Guided by graph theory, Network Models in Finance: Expanding the Tools for Portfolio and Risk Management provides a comprehensive overview of networks in investment management, delivering strong knowledge of various types of networks, important characteristics, estimation, and their implementation in portfolio and risk management. With insights into the complexities of financial markets with respect to how individual entities interact within the financial system, this book enables readers to construct diversified portfolios by understanding the link between price/return movements of different asset classes and factors, perform better risk management through understanding systematic, systemic risk and counterparty risk, and monitor changes in the financial system that indicate a potential financial crisis.

In this book, we showcase the broad and deep knowledge of network theory and its applications. Networks provide new perspectives for asset managers, offering insights into investment management topics highly relevant for institutional investors, family offices, researchers, academics, and industry practitioners. This book stands out by providing insights that extend current knowledge in network theory to address specific needs in portfolio and risk management. It offers a unique contribution compared to the existing literature, making it a valuable resource for understanding and applying network-based methodologies in asset management.

Network theory is a field of mathematics with roots tracing back to the works of some of the world’s most famous mathematicians, such as Leonhard Euler, Bernhard Riemann, and Henri Poincaré. It offers a framework for understanding and analyzing the relationships and interactions among interconnected entities. This theory extends the graph theory principles, founded by Euler’s solution to the Königsberg bridge problem. Network theory builds on these concepts to study more complex and large-scale networks, which can be found in various fields that will be discussed later in this book.

Covering a wide range of applications relevant to both practitioners and academics, we guide the reader by first developing a robust theoretical framework, and then providing practical illustrations and codes in the programming language R for actual portfolios comprising traditional and alternative asset classes, factors, and other economic variables like payments and transaction data. A major objective is to shed light on the problems faced by practitioners in portfolio management and risk management, considering that asset classes and factors are integrated into a holistic framework. Potential solutions to these problems are provided.

The primary distinction of Network Models in Finance, compared to other books on network modeling, lies in its comprehensive coverage of the visualization, analysis, research, estimation, and computation of a wide range of networks applied in asset management. This book focuses specifically on evaluating portfolio networks and investigating their properties.

With a practitioner-oriented approach, this book includes coverage of:

• Practical examples of broad financial data to show the vast possibilities to visualize, describe, and investigate markets in a completely new way

• Interactions, Causal relationships and optimization within a network-based framework and direct applications of networks compared to traditional methods in finance

• Various types of algorithms enhanced by programming language codes that readers can implement and use for their own data

Network Models in Finance: Expanding the Tools for Portfolio and Risk Management is an essential read for asset managers and investors seeking to make use of networks in research, trading, and portfolio management.

Contents:

Скачать Network Models in Finance: Expanding the Tools for Portfolio and Risk Management

[related-news] [/related-news]

Комментарии 0

Комментариев пока нет. Стань первым!